INSURANCE

PERSONAL INSURANCE

Personal insurance is a vital aspect of any comprehensive financial plan. It provides a safety net for you and your loved ones in the event of unexpected circumstances and helps protect your financial future. At True Wealth, we understand the importance of having the right insurance coverage in place, and our financial advisors are dedicated to helping you secure the coverage you need.

Insurance can be a complex and confusing topic, but it is essential to have a basic understanding of the various types of coverage available. Whether you are looking to protect your income, provide for your family in the event of your death or disablement, or ensure your financial stability during a critical illness, insurance can help.

Having the right insurance coverage in place can give you peace of mind and help ensure that your loved ones are protected in the event of the unexpected. It can also provide financial support during a challenging time, allowing you to focus on your recovery and not worry about the financial impact of a medical emergency or other unexpected event.

Partnered with Australia's top retail insurers

WHAT WE DO

If illness or injury prevented you from working, could you still survive? We assist Australians in answering affirmatively. We provide guidance and handle the necessary tasks to establish reliable Income, Life, Disability, and Trauma Insurance, ensuring you can maintain your lifestyle even if unforeseen circumstances interrupt your ability to work.

Get the right insurance

We'll educate you on the essentials, explore the market to find optimal choices, and complete the application forms on your behalf.

Change it as life does

Interested in updating your insurance or ensuring you're still getting the best value? That's precisely why we're here.

Get help at claim time

In the event of a claim, we'll handle all the insurance tasks for you, allowing you to concentrate on what truly matters.

PERSONAL INSURANCE

Personal insurance is a vital aspect of any comprehensive financial plan. It provides a safety net for you and your loved ones in the event of unexpected circumstances and helps protect your financial future. At True Wealth, we understand the importance of having the right insurance coverage in place, and our financial advisors are dedicated to helping you secure the coverage you need.

Insurance can be a complex and confusing topic, but it is essential to have a basic understanding of the various types of coverage available. Whether you are looking to protect your income, provide for your family in the event of your death or disablement, or ensure your financial stability during a critical illness, insurance can help.

Having the right insurance coverage in place can give you peace of mind and help ensure that your loved ones are protected in the event of the unexpected. It can also provide financial support during a challenging time, allowing you to focus on your recovery and not worry about the financial impact of a medical emergency or other unexpected event.

TYPES OF PERSONAL INSURANCE

Every form of insurance collaborates to safeguard you and your family financially, whether it's covering medical expenses, providing support if you're temporarily or permanently unable to work due to illness or injury, or offering assistance in the event of a loved one's passing.

Monthly payout

Income insurance

Provides a monthly payout in the event of illness or injury preventing you from working. This coverage offers up to 70% of your income, ensuring you can meet your financial obligations while recuperating.

Lump sum payout

Life insurance

Provides a lump sum payout in the event of your passing or terminal illness. This assurance brings peace of mind, ensuring that your loved ones can maintain financial stability even in your absence.

Disability Insurance (TPD)

Provides a lump sum payout in the event of permanent disability, rendering you unable to work. This sum can be allocated towards debt repayment, home modifications, or investment to generate future income.

Trauma Insurance

Provides a tax-free lump sum payout upon experiencing a severe medical condition like cancer, heart attack, or stroke. This assistance enables you to access top-tier medical care and take time off with your loved ones.

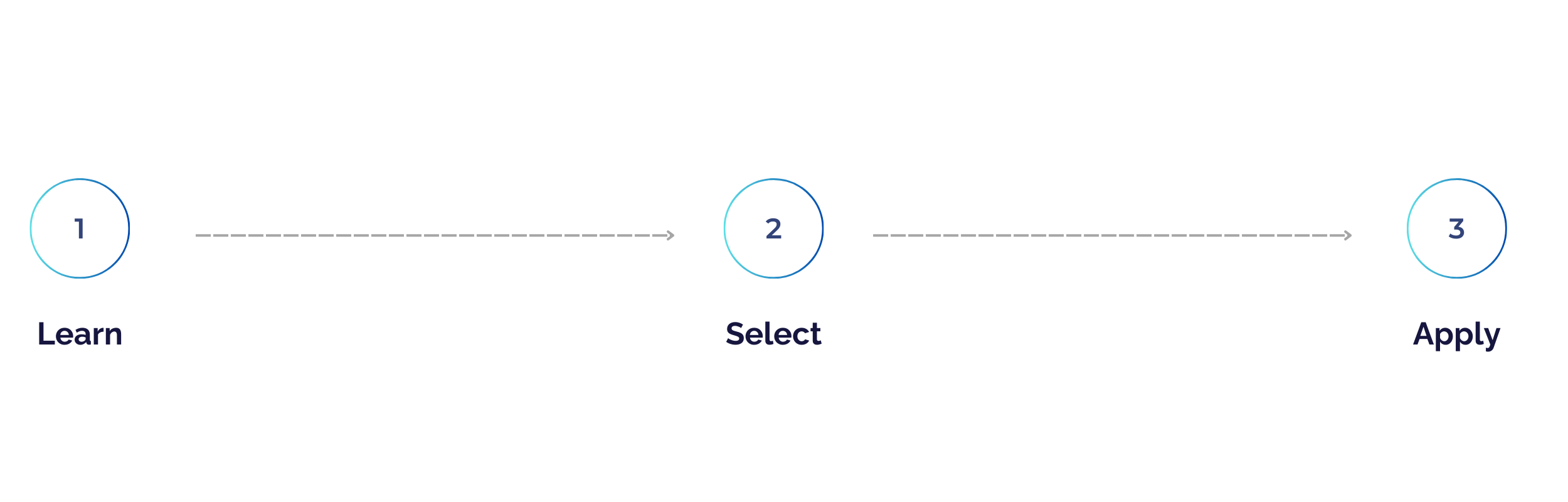

THE PROCESS

Three steps to peace of mind

We'll guide you through a comprehensive breakdown of each insurance type, elucidating various customization options to align with your unique life circumstances.

We'll handle all the groundwork of gathering quotes from Australia's primary retail insurers, streamlining the process for you to simply select the most suitable option.

Once you've made your selection, we'll inquire about the necessary details required by the insurer and proceed to submit the paperwork on your behalf.

Is it really that important?

Which insurances are essential? In essence, we recommend insuring possessions or risks that would pose significant financial strain if lost.

1 in 3

Aussies suffer a heart attack, stroke or cancer

18

Aussie families lose a working-age parent daily

1 in 8

Disabled Aussies became disabled due to an injury

Frequently Asked Questions

Since individuals vary, the necessary coverage is contingent on factors such as familial status, homeownership, age, occupation, savings, and other life circumstances. Consequently, it evolves in parallel with life’s changes.

The optimal moment to secure insurance is when the need arises. To recap, here’s when to contemplate obtaining each type of insurance:

- Income Insurance: If a month to several years off work would pose financial strain.

- Life Insurance: If your loved ones would face financial repercussions in the event of your demise.

- Disability Insurance: If immediate retirement isn’t financially feasible due to disability.

- Trauma Insurance: If unforeseen medical expenses or time off work with loved ones would require financial assistance.

You’ll only incur expenses for the insurance itself as we don’t levy any fees for our service. Moreover, there are no additional charges tacked onto the insurance price, ensuring parity with direct purchase. The insurance cost is contingent upon your choices, age, and health status. Following a brief 10-minute conversation, we’ll furnish you with quotes from all relevant insurers, empowering you to assess the prices before committing. It’s important to note that we receive compensation from the insurer, without any additional expense to you.

Certainly. Income, Life, and Disability Insurance are eligible for payment within your super (unlike trauma insurance). Opting to pay for your insurance through super offers the advantage of a 15% tax rebate. This translates to a 15% reduction in cost compared to paying out of pocket, without impacting your cash flow. However, it’s important to acknowledge that the premiums will be deducted from your super balance, potentially affecting your retirement savings. If desired, you have the option to contribute extra to your super to cover the premium amount.

It’s worth noting that Income Insurance is tax-deductible. Therefore, if you’re in a higher tax bracket, you might save more by paying for it outside of super. We’re available to discuss various options with you to find the most suitable approach.

Many super funds offer a standard level of insurance through your super. Nonetheless, there are two considerations to keep in mind. Firstly, this coverage may not be tailored to your specific needs. Consequently, you might be overpaying for coverage you don’t require, or worse, you might find yourself underinsured. Typically, insurance within super isn’t medically underwritten, meaning insurers haven’t assessed your health and lifestyle. As a result, the terms could be subject to change at any time, and there’s no assurance that you’ll receive the agreed-upon payout.

Outside of super, only Income Insurance is tax deductible. Life and Disability Insurance aren’t tax deductible when paid for directly, but if paid for within super, you’d receive a 15% rebate. This same rebate applies to Income Insurance if paid for within your super. Trauma insurance, however, isn’t tax deductible regardless of payment method.

Personal insurance policies don’t entail lock-in contracts, allowing for adjustments as life circumstances evolve. It’s advisable to consider reviewing your insurances during significant life events such as purchasing a home, changing employment, altering marital status, or starting a family. Although we’re readily available for discussions, we’ll also reach out every two years to provide a comprehensive review of your insurance coverage, ensuring it remains suitable for your needs and remains within your budget.

TRUE WEALTH AND INSURANCE

Our financial advisors understand the complex nature of personal insurance and are trained to help you select the right coverage for your individual needs. They will work with you to understand your financial situation, discuss your insurance needs, and recommend the best insurance solutions for you.

At True Wealth, we take pride in providing comprehensive and personalized financial planning services. Our team of experienced financial advisors is here to help you navigate the insurance landscape and ensure that you have the right coverage in place to protect you and your family.

If you have any questions or would like to discuss your personal insurance needs, please don’t hesitate to contact us. We are here to help and ensure that you have the peace of mind knowing that you and your loved ones are protected.